On Nov. 29, the LogicManager community arrived at Hotel Commonwealth in the historic Fenway district of Boston for sold-out IMPACT 2018. Every year, LogicManager hosts a customer conference where users of the ERM software can learn, share, and grow their risk management program to full maturity.

Upon walking into the conference space, you could feel the partnership LogicManager strives to create between customer and employee. As a SaaS provider, most of our work is virtual. But at IMPACT, it was like old friends coming together as advisory analysts eagerly sought out the risk professionals they’ve developed relationships with over the years.

Between sessions, attendees and analysts met to share their thoughts on the conference and brainstorm ways they could better leverage the tool. Customers also connected with fellow users to exchange ideas. These relationships are what make LogicManager more than a software, but rather a partner in achieving excellence.

Above all, what continues to be the most striking part of IMPACT is the willingness with which each customer presents on their successes, challenges, and future goals, while openly sharing the steps others can take to overcome existing obstacles or conquer new initiatives. IMPACT has and always will be a conference by practitioners, for practitioners.

A lot happened during the two-day event, so we broke IMPACT 2018 down into some recurring themes alongside the tips every governance, risk, and compliance professional can use to mature their ERM program.

Risk Management for a Better Tomorrow

Steven Minsky, CEO and Founder of LogicManager, continued this theme throughout his opening keynote session. He explored what it meant to build a better tomorrow through risk management. Namely, it’s to prevent distracting mishaps that threaten to derail a company’s mission, whether that be keeping satellites in the sky or making sure every customer’s transaction is safe and secure.

“Every hero has a Lex Luthor,” Steven said, as he dove into one obstacle risk managers face: the see-through economy. In the past 10 years, information sharing has changed drastically, to the point where PR no longer works, and prevention is the only way to keep corporate scandals out of the picture.

“Every hero has a Lex Luthor,” Steven said, as he dove into one obstacle risk managers face: the see-through economy. In the past 10 years, information sharing has changed drastically, to the point where PR no longer works, and prevention is the only way to keep corporate scandals out of the picture.To this end, Steven outlined the steps every risk professional can take to adapt to the see-though economy:

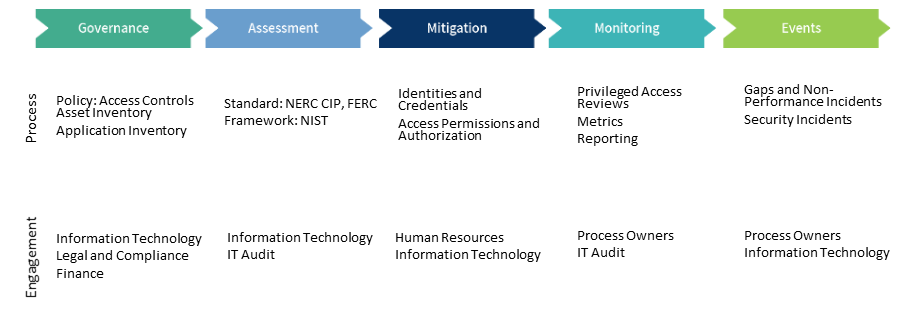

Take a Risk-Based Approach – Integrate all governance areas and activities into one iterative process, including governance, identification, assessment, mitigation, monitoring, and events.

Engage the Business – Reach out to as many departments and levels as you can to collect relevant, accurate information to anticipate and address enterprise risk.

Put it all Together – For any initiative, look at what processes need to be carried out under each step of a risk-based approach and engage the appropriate personnel.

Consolidate Reporting – Turn brick-sized board reports into one-page dashboards by aggregating and filtering information by what your audience is interested in.

Engage the Business

Every presenter seemed to be on board with this integral step to taking a risk-based approach. As the name implies, enterprise risk management is a sprawling, company-wide process which should never be limited to one department. It takes a host of subject matter experts and front-line personnel to get an accurate picture of an organization’s risk profile.

So what are some tips the presenters shared on engagement?

Develop a Common Language – Departments talk about risk differently. One person’s “analysis” is another’s “assessment.” It’s important to speak the same risk language in order to engage people in a risk-based approach.

Grab a Cup of Coffee – During a panel on building an effective ERM program, three professionals shared their view on approaching other departments with a cup of coffee and genuine questions about which processes aren’t working. They stressed the importance of not imposing a new system or point of view, but sharing solutions to their individual challenges.

Create a Risk-Aware Culture – In a panel discussion, members of DigitalGlobe and Maxar Technologies discussed the effectiveness of regular, in-person training sessions. In these sessions, employees are encouraged to identify their own risks and have open dialogues about how to assess them.

Demonstrate Success – Regularly present on the success you’ve had with a risk-based approach. Even small wins entice others to join the journey and make improvements of their own with the same method.

Add Capacity to Add Value

Many presentations remarked how much capacity they were able to create with an online system. As the Risk-Based Approach Wheel demonstrates, there’s a lot that goes into a mature risk management process. Getting bogged down in manual processes takes a lot of time away from the value-adding initiatives a company could be pursuing.

Here are the top tips for creating more capacity:

Centralize Information – Create a centralized repository for all risk information. Almost every presentation cited Word documents and spreadsheet systems as prior pain points because of the amount of time they took to update and track down.

Automate Workflows – Shuffling tasks from person to person and manually following up with people takes time. Many of the presenters talked about how they leveraged incident forms and automated workflows to create more capacity for themselves.

Consider Dude’s Law – Christi Woods from Teacher Retirement System of Texas shared Dude’s Law, in which Value = Why / How. In other words, if the “why” of what you’re doing is greater than “how” you’re doing it, you’re adding value. Automated systems decrease the “how” and increase value.

Embrace Change

Every single presenter touched on change at their company. The changes they discussed came in many forms, from organic growth to mergers and acquisitions. This was a poignant theme to explore throughout the conference because ERM is about adapting to change and maintaining repeatable, yet flexible processes.

Stick to Your Guns – The folks from DigitalGlobe had a lot to say about change after being acquired by Maxar. They viewed the merger as an opportunity to speak up for the process they believed in and to be a champion for a risk-based approach across the new enterprise.

Standardize, Standardize, Standardize – In moments of change, everyone needs to be on the same page. Panelists from Cognition Financial, IHS Markit, and Reverse Mortgage Funding advised the audience to centralize information and methodologies. Having a point person to mediate the standardization process is a must.

Engage Early and Often – With innovation comes risk. When a new process is being created, you want people to automatically think what its risks are. Engaging as many people as you can, as often as you can, in the risk management process is the best way to keep them risk-aware.

What’s on the Horizon?

Each customer presentation ended with a look towards the future. What did they want to improve on? How were they going to get there?

LogicManager had a few goals of our own to share.

Say Hello to Horizon – The LogicManager team introduced LogicManager Horizon, the latest version of our software. Why Horizon? Because we believe risk managers are the harbingers of a better tomorrow, and we want to provide them a new line of sight to what’s possible.

Keeping Engagement at the Forefront – LogicManager Horizon prioritizes solutions that will impact the most end-users. We’ve already deployed our newly designed incident webforms to increase engagement across organizations.

What’s Next – Redesigned home screen. Mobile accessibility. Improved infrastructure. This is just some of what LogicManager users can expect from LogicManager Horizon. What lies beyond Horizon? To close the event, CEO Steven Minsky discussed the role artificial intelligence will play in the risk management industry. We’re encouraging our customers to provide feedback on what kinds of technology will provide them more intelligent insights faster.

That’s a Wrap!

As always, the customers were the stars of IMPACT 2018. We loved seeing those who believe in LogicManager every year and how much they’ve grown their ERM programs. We can’t get enough of the customer-to-customer interactions as they share their success, learn from each other, and grow their skill sets.

We can’t wait to see everyone back at IMPACT 2019!

This article was originally published on LogicManager.com

The post IMPACT 2018: Becoming a Risk Management Hero appeared first on insBlogs.

Scandals, predictions, and insights, oh my! We’ve covered a lot of ground this year in the risk management world. But what were the topics people were buzzing about most?

Scandals, predictions, and insights, oh my! We’ve covered a lot of ground this year in the risk management world. But what were the topics people were buzzing about most? : Governance, Risk, and Compliance Platforms, Q1 2018 named LogicManager a Leader in ERM platforms! But aside from this honor, we wanted to take a deeper dive into some of the insights presented in the report.

: Governance, Risk, and Compliance Platforms, Q1 2018 named LogicManager a Leader in ERM platforms! But aside from this honor, we wanted to take a deeper dive into some of the insights presented in the report. There’s an undeniable shift occurring in the business world right now. In fact, it’s been forming since 2007. I’ve coined the phrase the See-Through Economy to encapsulate the shift towards transparency and accountability brought on by new technology and social media.

There’s an undeniable shift occurring in the business world right now. In fact, it’s been forming since 2007. I’ve coined the phrase the See-Through Economy to encapsulate the shift towards transparency and accountability brought on by new technology and social media. Today the economy is strong and your business is doing well. But are you prepared for when this strength turns to weakness? Enterprise risk management has been proven to help companies survive a recession.

Today the economy is strong and your business is doing well. But are you prepared for when this strength turns to weakness? Enterprise risk management has been proven to help companies survive a recession. Even a $1 trillion company cannot hide in the See-Through Economy. After a fourteen-year-old boy discovered a serious bug in Apple’s group FaceTime feature, his mother e-mailed, faxed, and tweeted the report to Apple. However, it wasn’t until after her tweet went viral that the bug was disabled. How could Apple have responded more efficiently and avoided this reputational risk?

Even a $1 trillion company cannot hide in the See-Through Economy. After a fourteen-year-old boy discovered a serious bug in Apple’s group FaceTime feature, his mother e-mailed, faxed, and tweeted the report to Apple. However, it wasn’t until after her tweet went viral that the bug was disabled. How could Apple have responded more efficiently and avoided this reputational risk? For the first time, reputation risk, organizational culture, and cybersecurity have all landed among the top five risks in the energy industry. How can energy companies tackle all of these risks without wasting time and money on additional resources?

For the first time, reputation risk, organizational culture, and cybersecurity have all landed among the top five risks in the energy industry. How can energy companies tackle all of these risks without wasting time and money on additional resources?

The banking industry is perceived as the most advanced in their understanding and implementation of risk management. Although banks have indeed made huge progress in risk management, two areas all banks can improve is the structure used in conducting their assessments to enable actionable and insightful strategic reporting.

The banking industry is perceived as the most advanced in their understanding and implementation of risk management. Although banks have indeed made huge progress in risk management, two areas all banks can improve is the structure used in conducting their assessments to enable actionable and insightful strategic reporting.